WHEN GIANTS GROW OLD (PART 2)

Tokenization and the Future of Urban Development

*This is the second part of a two-part series on New York's aging infrastructure. Read Part 1 here.*

What if the next Empire State Building isn't built by a developer, but by thousands of New Yorkers?

The audacious speed of the Empire State Building's construction stemmed from desperation—a testament to what's possible when traditional constraints are ignored. Today, as New York's aging giants crumble and ultra-luxury developments dominate the skyline, we face a different kind of desperation. The gap between our cities’ old infrastructure and modern needs widens daily, while the tools to bridge it remain locked in the hands of a few entrenched interests.

Beyond the noise of memecoin mania—from $TRUMP tokens to AI-generated scams—lies a more profound application of digital assets: reimagining how we build and fund our cities.

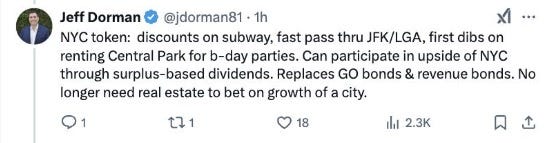

Jeff Dorman of Arca recently outlined a vision where city tokens could transform metropolitan governance. Imagine an NYC token offering not just practical benefits like subway discounts or airport fast-tracks, but a revolutionary model of urban participation. This isn't about creating another tradable digital asset—it's about redistributing the power to shape our skyline.

Compare this with memecoins. While digital jokes capture headlines, the real potential of tokenization lies in solving tangible problems. A comprehensive NYC token ecosystem could create funding mechanisms that reduce our reliance on wealthy developers while ensuring that the benefits of our cities’ development extend beyond the penthouses of Billionaires' Row.

This transformation is closer than most realize. Dorman outlines a future where universities offer tokens combining tuition benefits with alumni participation rights, and sports teams create fan tokens merging season tickets with revenue sharing. Cities are the logical next step.

The technology exists—smart contracts can already handle complex financial arrangements and voting rights. As regulatory frameworks evolve, the path to asset tokenization becomes clearer.

For New York's aging infrastructure, this shift couldn't come at a better time. Municipal bonds and private equity just can’t cut it anymore. A tokenized approach to urban development would create a new category of stakeholder: the citizen-investor, equally invested in both financial returns and quality-of-life improvements. Imagine local businesses pooling resources to renovate their block, or neighbors coming together to fund and shape their community's future.

The Empire State Building showed us that crisis breeds innovation. As our infrastructure ages and wealth gaps widen, tokenization offers more than just a new financing model—it provides a framework for democratic urban development. The future of New York's skyline won’t just be written in glass and steel, but in the collective will of its citizens to shape their city.